Tesla experienced a significant drop in year-over-year profits during the first quarter, primarily due to reduced delivery numbers, which were partially connected to CEO Elon Musk’s political activities. Both revenue and net profit fell short of what financial experts had projected, with factors such as factory upgrades for upcoming vehicle models and economic instability contributing to decreased consumer interest.

Even though the outcomes were underwhelming, Tesla’s stock price surged over 5% during extended trading hours, fueled by an overall upswing in financial markets following comments from U.S. President Donald Trump stating his intent not to remove Federal Reserve Chairman Jerome Powell. Nonetheless, Tesla’s share value has dropped by 34% since the start of the year, marking it as the poorest-performing asset within what is known as the Magnificent Seven technology equities.

Tesla’s earnings fall sharply

In the first three months of the year, Tesla’s automotive revenue declined 20% year-on-year to $14 billion (€12.28 billion), while earnings per share dropped 40% to $0.27 (€0.23). Total revenue fell 9% from a year earlier to $19.3 billion (€16.92 billion). Meanwhile, revenue from energy generation and storage rose by 67%, achieving “a fourth sequential record for Powerwall deployments.”

The company’s earnings statement pointed out that the decrease in revenues was partly because of lower car deliveries. This downturn included factors such as an upgrade for the Model Y affecting all four manufacturing plants, a reduction in the average sale price per vehicle owing to changes in model mix and promotional offers, and unfavorable currency fluctuations. Nonetheless, expansion in both energy production and storage solutions, coupled with higher income from regulatory credits, managed to mitigate some of this decline somewhat.

In the first quarter, Tesla delivered 336,681 vehicles, which represents an 13% decrease compared to the same period last year and marks their lowest delivery figure since 2022. It should be noted that the initial three months of the year usually see weaker performance for Tesla.

As the energy sector maintained its consistent expansion, anticipated issues with supply limitations and tariffs could affect battery manufacturing. The firm stated, “The megafactory in Shanghai will serve as a crucial resource for addressing worldwide energy storage needs amid unstable cost structures in the U.S.” During the earnings call, CFO Vaibhav Taneja remarked that the influence of these tariffs on the energy division is disproportionately large due to China being the primary source of most battery cells. In contrast, domestically produced American cells account for just a minor share within this area, and transitioning to sources outside of China would require considerable time.

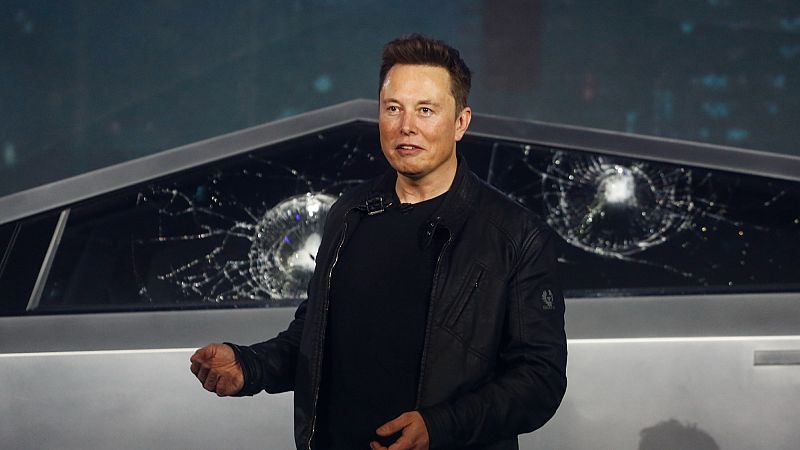

Musk addresses political backlash

Tesla’s reputation has faced challenges because of Musk’s political engagements at home and abroad. Demonstrations have occurred near Tesla dealerships across the United States, Europe, and Australia. His backing of Germany’s extremist AfD party and his role in counseling Trump about significant reductions in federal employment have garnered substantial backlash.

During the earnings call, the CFO mentioned that “negative effects from vandalism and unjustified animosity toward our brand and employees” in specific regions have affected deliveries. Musk asserted without providing proof that the protesters were being compensated: he suggested they were getting “fraudulent payments” or were beneficiaries of “wasteful spending.”

Musk stated that the amount of time he dedicates to the Department of Government Efficiency (DOGE) will significantly reduce beginning in May. His plan involves spending “one or two days each week” on governmental duties, continuing “as long as the president wants my involvement.” During an event held in Wisconsin recently, he mentioned that fulfilling these responsibilities has been quite costly for him personally. Additionally, he expressed backing stable tariff systems, unrestricted commerce, and reduced import taxes, stating that he had offered counsel to the U.S. President. Nevertheless, Musk clarified, “I am not assuming the presidency myself.”

Robotaxi and Optimus

Earlier, Musk mentioned that unsupervised Full Self- Driving (FSD) was expected to roll out in California and Texas by June. Additionally, the service plans to make its first appearance in Austin featuring the Model Y with a “localized parameter set.” Now, he indicates that Tesla’s Robotaxi service will be accessible across multiple cities before the end of this year.

In addition, Musk noted that production of Tesla’s AI-powered humanoid robot, Optimus, has been impacted by magnet supply issues, which may lead to delays. China recently imposed restrictions on rare earth exports in retaliation for Trump’s tariffs as the US–China trade war escalates. Tesla had previously aimed to produce several thousand Optimus robots this year.