Discover the Best Alternatives to Mint for Budget Tracking in 2025

As users navigate the recent announcement regarding the shutdown of Mint by Intuit, many are left searching for effective alternatives for tracking their finances. Mint has been a popular financial tool that facilitated the management of multiple accounts, credit scores, and budgeting tasks for millions. With the goal of finding a suitable replacement, here’s a comprehensive guide to the best budgeting applications available today.

Top Budgeting Apps to Consider

1. Quicken Simplifi

- Monthly Cost: $4

- Spending Tracking: Yes

- Investment Tracking: Yes

- Mobile Access: iOS, Android

Quicken Simplifi stands out as the top alternative to Mint, thanks to its user-friendly interface and impressive income and bill detection capabilities. This application is not only less expensive than many competitors, but it also allows shared access for spouses or financial advisors.

Pros:

- Intuitive interface with a gentle learning curve

- Accurately detects recurring payments

- Affordable pricing model ($72/year)

Cons:

- No free trial is available

- Limited account setup options (no Apple or Google ID support)

- Lacks integration with Zillow for real estate tracking

Key Features: A clean dashboard displays vital statistics, including recent expenditures and savings goals, making it easy for users to manage their finances.

2. Monarch Money

- Monthly Cost: Starts at $9

- Spending Tracking: Yes

- Investment Tracking: Yes

- Mobile Access: iOS, Android

Monarch Money, founded by a former Mint developer, offers a robust budgeting experience, though it has a steeper learning curve compared to Simplifi.

Pros:

- Comprehensive customization options

- Detailed monthly review of finances available

- Allows account sharing with family members

Cons:

- Complicated user interface, especially on mobile

- May require manual input for some recurring transactions

- Higher monthly fee ($100/year)

Key Features: A unique balance sheet and customizable expense categories provide a detailed view of one’s financial standing.

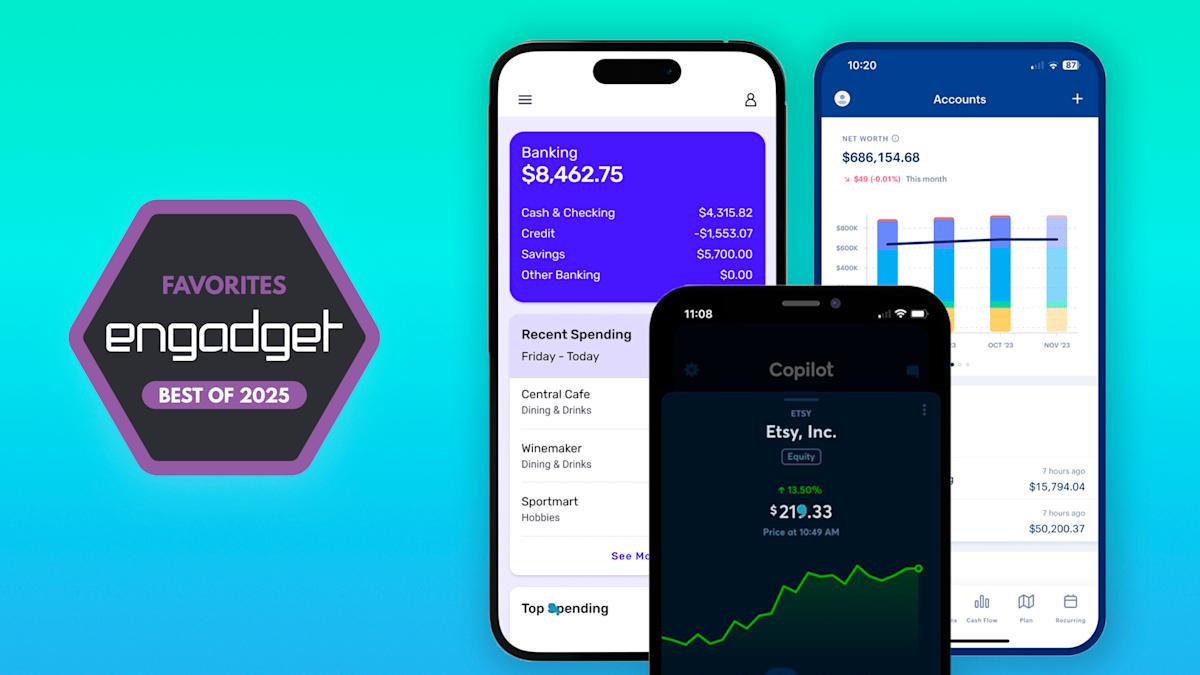

3. Copilot Money

- Monthly Cost: Starts at $8

- Spending Tracking: Yes

- Investment Tracking: Yes

- Mobile Access: iOS

Copilot Money is visually appealing and offers a user-friendly design; however, it currently only supports iOS and Mac systems.

Pros:

- Clean, visually striking interface

- Integration with Amazon and Venmo

- Ongoing development of new features

Cons:

- Lacks Android and web app availability

- Higher incidence of expense misclassification

Key Features: Copilot’s standout feature is its graphical representation of monthly expenditures, making financial trends easy to identify.

4. NerdWallet

- Monthly Cost: Free

- Spending Tracking: Yes

- Investment Tracking: Yes

- Mobile Access: iOS, Android

For those seeking a free budgeting tool, NerdWallet offers essential features without the cost, though ads are prevalent.

Pros:

- No subscription fees

- User-friendly structure and intuitive layout

- Comprehensive financial guides and resources

Cons:

- Ads can be distracting

- Limited customization options for spending categories

Key Features: Ideal for those wanting straightforward budget tracking and who appreciate added financial resources.

5. YNAB (You Need A Budget)

- Monthly Cost: Starts at $8

- Spending Tracking: Yes

- Investment Tracking: Yes

- Mobile Access: iOS, Android

YNAB promotes a hands-on approach to budgeting through its zero-based budgeting system, making it popular among users seeking financial discipline.

Pros:

- Strong emphasis on proactive financial planning

- Offers extensive learning materials

Cons:

- Steeper learning curve for new users

- Higher annual cost of about $110

Key Features: Its focus on assigning every dollar a purpose helps users understand their financial habits more clearly.

Data Migration for Mint Users

For Mint users looking to transfer their financial data to a new application, it’s important to prepare for this process. Most systems require data to be uploaded via CSV files, which can be exported from Mint through the transactions menu.

Conclusion

Following the discontinuation of Mint, these budgeting applications provide viable alternatives, each with its unique features and strengths. By prioritizing user needs and financial goals, individuals can select the best tool to help navigate their budgeting journey effectively. Whether you opt for Quicken Simplifi’s simplicity, Monarch Money’s depth of features, or the zero-cost option from NerdWallet, each app offers distinct avenues to achieve better financial management.

For further assistance, consumers are encouraged to research reviews and testimonials to ensure the selected application meets their specific requirements.