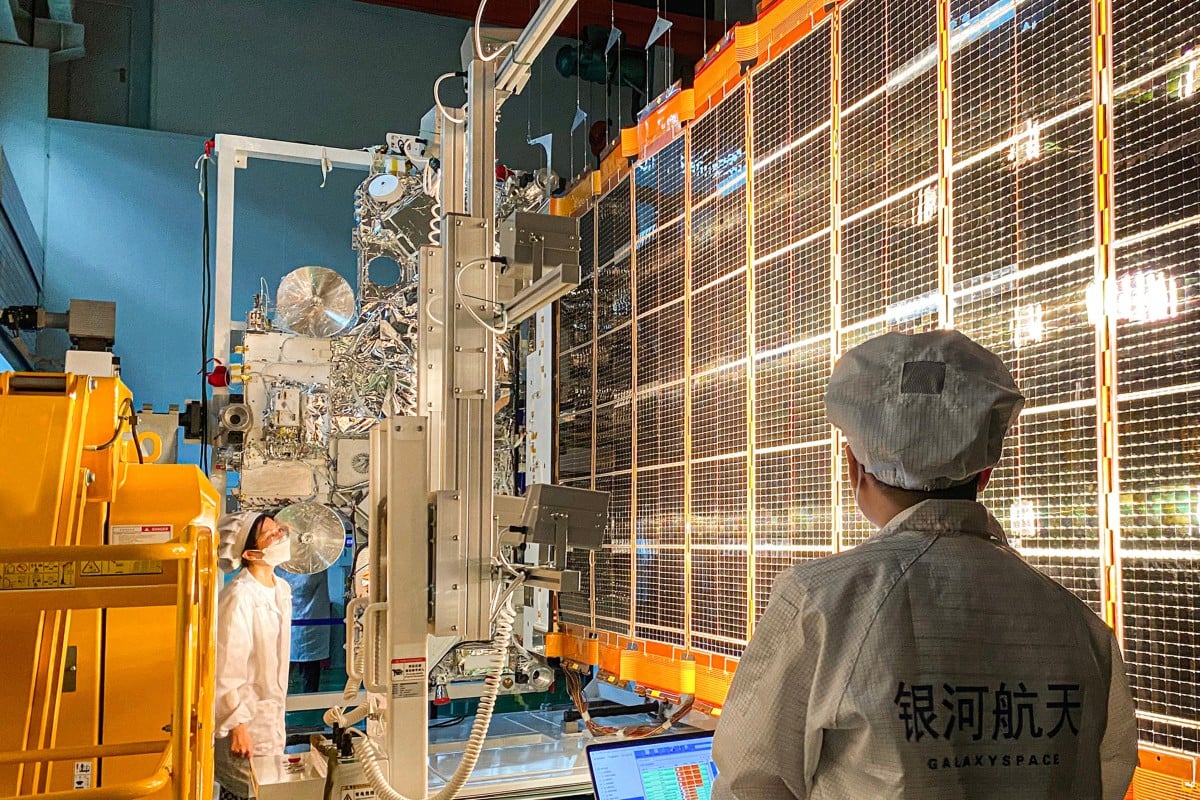

A intensifying trade conflict with the United States will accelerate China’s initiatives to reduce expenses related to making and launching satellites through adopting homegrown technologies instead of imported components as Beijing hastens to close the gap technologically.

Elon Musk’s Starlink

as mentioned by someone with inside knowledge of the industry.

The trade restrictions could affect up to 30 per cent of the US-sourced specialised satellite components, according to a senior executive from a leading Chinese commercial satellite company, who asked not to be named due to the sensitivity of the matter.

China has increased its charges on American products to 125%, adding these rates to previously imposed duties. This action comes as China retaliates against the additional tariffs totaling 145% that were introduced by President Donald Trump’s administration upon Chinese goods following his return to office. Consequently, the overall tax applied to items imported from China into the United States currently amounts to approximately 156%.

Are you looking for insights into the most significant issues and developments globally? Find your answers here.

SCMP Knowledge

Our latest platform features handpicked content including explainers, FAQs, analyses, and infographics, all provided by our acclaimed team.

While Trump has introduced a 90-day pause for most countries and pressured other nations to limit their trade with China in return for tariff exemptions, the levies on China remain in place, with no sign that Trump will back. At the same time, Beijing has vowed to “fight until the end”.

“In technical terms, these components of satellites could theoretically be produced locally, however, the primary issue lies in the fact that manufacturing them within the country would incur greater expenses,” explained an official from the satellite corporation.

According to an insider, the increased production expenses were attributed to the limited-scale manufacturing of emerging Chinese aerospace items that had not yet gained widespread adoption within the commercial space industry.

Beijing’s preference for using components that have proven to be safe and reliable has led to a dependence on US-made products, according to the executive.

He noted that if all satellite components were sourced domestically in the future, circumstances could differ.

“The US-China trade war could ultimately prove to be more beneficial than detrimental for us over time,” the source noted.

The competition between the United States and China for supremacy in space is intensifying, turning this celestial domain into a crucial arena of their escalating rivalry. While Beijing sets its sights on achieving great-power status in space by 2045, the U.S. remains steadfast in its commitment to retaining control over this final frontier.

The achievement of prominent U.S. aerospace firms such as

SpaceX

and

Blue Origin

, many of which produce most of their own components to maintain quality control and foster innovation, have resulted in increased pressure to secure the industry’s supply chains and manufacturing within U.S. borders due to economic and national security concerns.

The executive stated that Chinese satellite firms thought their primary strengths lay in

Elon Musk

SpaceX’s satellite constellation firm, Starlink, benefited from lower manufacturing and launch expenses.

“Since satellite internet services require the deployment of thousands of satellites, controlling these two costs is crucial for commercial viability,” he said.

SpaceX’s launch business delivered payloads into orbit for five to 10 times less cost than most of its competitors last year, with the cost per launch of a single Falcon 9 rocket estimated to be US$20 million, according to a report published by Morgan Stanley in March 2024.

The current cost per launch for Chinese commercial satellite companies was about 10 times higher than that by SpaceX, the executive said.

Out of a total of 259 satellite launches conducted worldwide in 2024, SpaceX carried out 134 – more than half of the world total – while China made 68 launches, according to Virginia-based media outlet SpaceNews.

David Chew, a Tokyo-based satellite expert, said launch costs were the “differentiator” in the global space race.

“Launching cost is very cheap with SpaceX due to their scale and reusability,” Chew said.

However, China’s launch costs are increasingly closing the gap because Chinese space experts demonstrate significant enterprise, coupled with governmental competition at both provincial and municipal levels.

More Articles from SCMP

‘Unexpected’ Chinese military helicopter exercises at sea indicate shifting tactics towards Taiwan, say analysts.

Filipinos mourn the passing of Pope Francis, their ‘Lolo Kiko’: ‘We feel like orphans’

China does not desire the Western involvement in the quagmires of Ukraine and the Middle East.

The Taiwan opposition conference seeks to address alleged DPP ‘oppression’ as recalls unfold.

China’s humanoid robotics industry moves into large-scale production with Unitree and AgiBot leading the way.

The article initially appeared on the South China Morning Post (www.scmp.com), which serves as the premier source for news coverage of China and Asia.

Copyright © 2025. South China Morning Post Publishers Ltd. All rights reserved.