We explore the current status of the electric vehicle charging sector as of the first quarter of 2025.

The sale of electric vehicles has surged dramatically, with more than 3 million units now operating on American streets just within the past three years. The critical issue arises: Is the nation’s publicly available EV charging network expanding at a comparable pace? This turns out to be quite a challenging query to resolve. However, addressing this matter is crucial because concerns about insufficient access to charging points remain among the primary barriers to greater acceptance and use of electric vehicles.

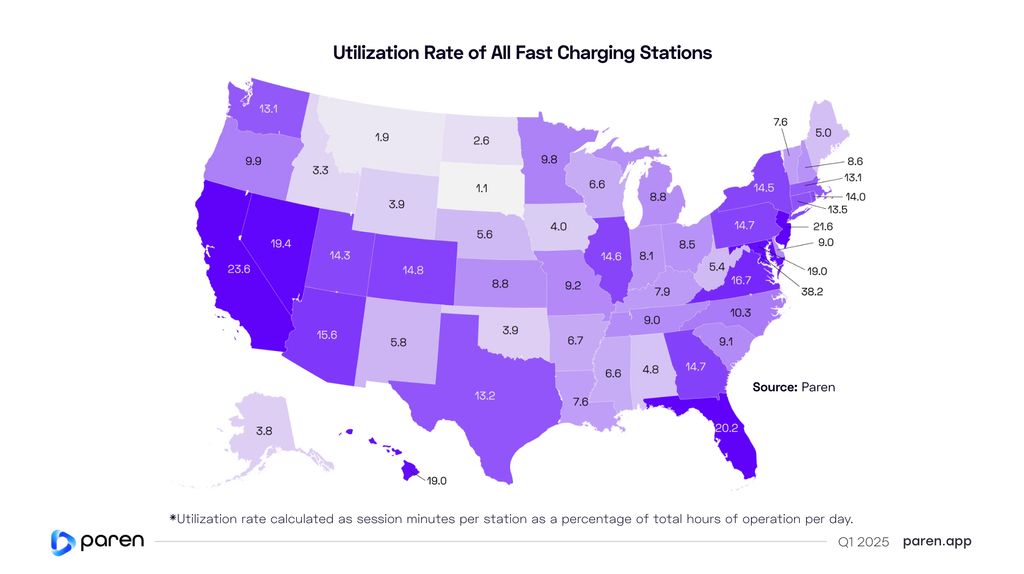

Merely computing the proportion of electric vehicle (EV) chargers to EVs nationwide does not provide a complete picture, according to Loren McDonald, lead analyst at Paren, a company specializing in charging data. If simplicity were key, states such as Oklahoma—which boasts numerous chargers yet sees low numbers of EV ownership—would seemingly become ideal havens for EV owners.

“Using those ratios could lead you to the wrong conclusion,” he told

InsideEVs

What proves more valuable is analyzing usage rates across major regions—specifically, how frequently charging stations are being used throughout the day. When you analyze these figures, it becomes clear that whether there are sufficient chargers depends greatly on your location within the country.

For

A study on the current condition of the electric vehicle charging sector

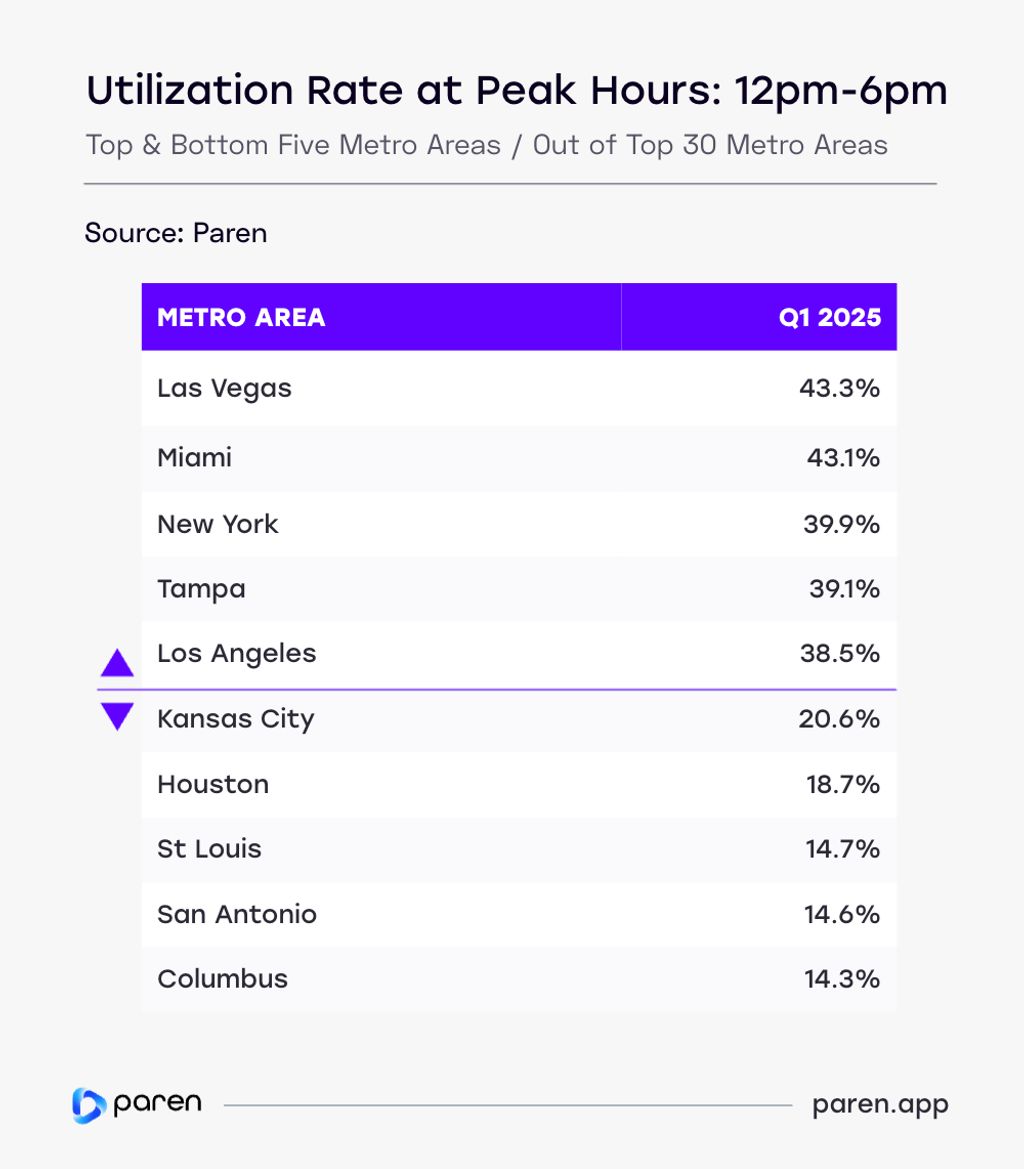

out on Tuesday, Paren tracked utilization of EV fast chargers during the peak hours of 12 p.m. to 6 p.m. in major markets. Las Vegas had the highest utilization rate at 43.3%. Columbus, Ohio, had the lowest at 14.3%.

According to McDonald, that means you’ll likely have to wait in line for a charger in some of the top markets. But on the flip side, there’s more than enough infrastructure to meet demand in many U.S. cities and states. On the whole, he says the U.S. is doing pretty well.

“In most of the country, we have plenty of charging infrastructure, at least in the core markets,” he said.

The average usage has exceeded 25% in multiple regions, according to McDonald, indicating positive developments for a sector that traditionally found it challenging to maintain profitability. This milestone underscores his view that the electric vehicle charging market is entering a new phase: “Charging 2.0.”

“We’re transitioning from those awkward teenage years with pimples to becoming adults,” he stated. McDonald highlights several signs indicating that progress is heading in the appropriate direction.

New entrants with significant market presence are making bold moves into this sector. Retail giants such as Wawa, Sheetz, and 7-Eleven, which include convenience stores and gasoline stations, are leading the charge.

BP

and Circle K see dollar signs in the longer duration of EV pit stops. Plus, car companies now realize they need to provide better charging to sell more cars. That’s enticed

Mercedes-Benz

, Rivian and

Ionna

—funded by a super-group of automakers—to launch charging networks of their own, like Tesla did back in the day.

“All these big companies are entering the market with significant funds and various motives for constructing charging stations,” McDonald stated.

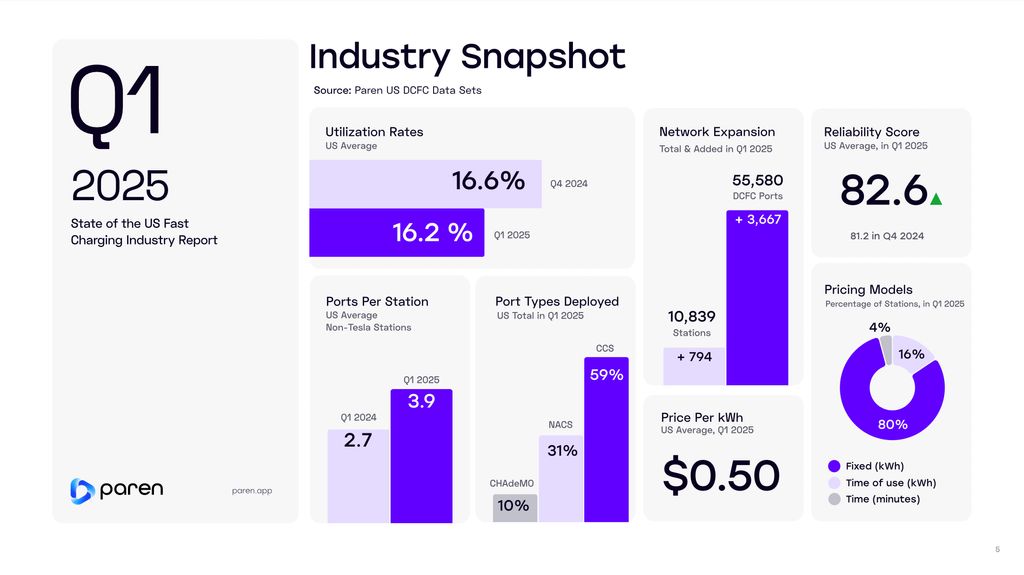

According to Paren’s report, EV charger reliability among non-Tesla sites—a nagging issue for years—improved in Q1 too. The firm’s reliability index ticked up from 81.2 to 82.6 quarter-over-quarter. It says that’s thanks to efforts to replace aging hardware.

New stations are getting bigger as well. The average new non-Tesla site built in Q1 had 3.9 ports, up from 2.7 during the same period last year. And the U.S. gained 3,667 chargers and 794 stations in the first three months of 2025.

To be sure, large swathes of rural America are still sorely in need of more charging stations. Not helping matters: the uncertain fate of funds from the $5 billion National Electric Vehicle Infrastructure (NEVI) program. The Trump administration

effectively halted that initiative in February

As InsideEVs initially reported, NEVI aims to support the development of fast-charging stations along key transportation routes, particularly in areas where commercial charging networks may lack profitability.

If this funding is at risk, charging companies will concentrate on lucrative regions where they are certain to generate profits, according to McDonald. This could exacerbate the disparity in charging infrastructure and leave more prospective electric vehicle purchasers hesitant.

There isn’t much financial opportunity in states like Wyoming and Montana. The main aim of NEVI was to address this issue,” McDonald stated. “On a positive note, rapid charging infrastructure has developed significantly and is now profitable. However, profitability varies across different regions.