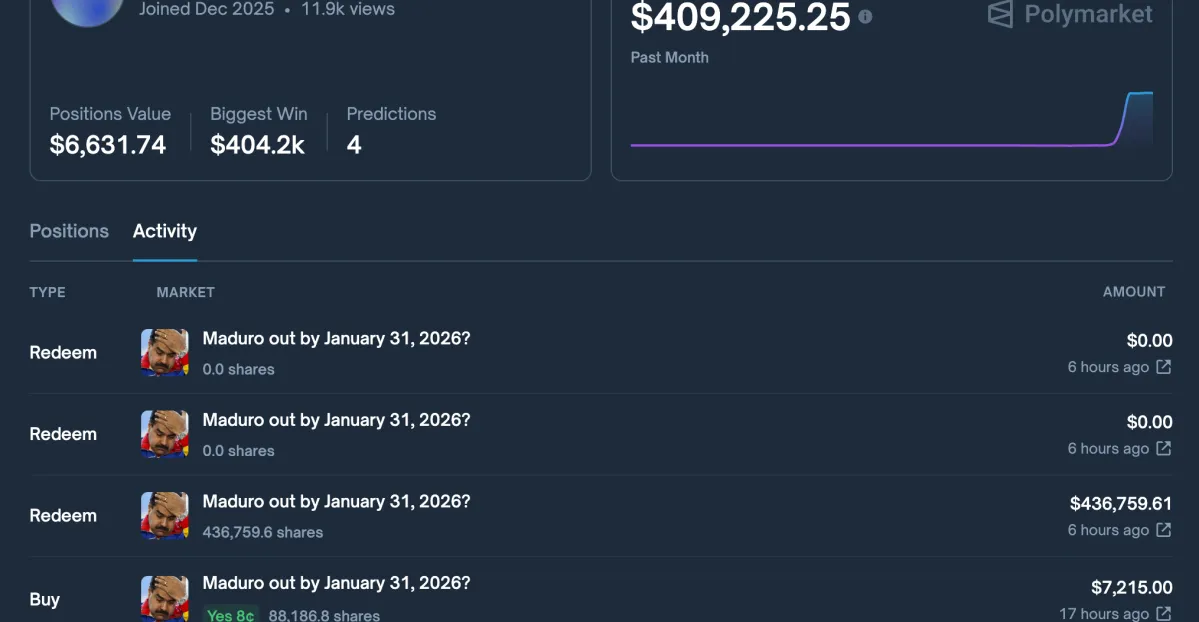

Shortly before the U.S. military launched an attack on Venezuela and captured President Nicolás Maduro, a suspicious investment pattern emerged on Polymarket. This prediction market allowed users to place bets on when or if Maduro would lose power, with prices for “out by January 31, 2026” dropping as low as $0.07 late Friday evening. Remarkably, within 24 hours of the military action, a newly created account made a substantial investment of tens of thousands of dollars, resulting in profits that surpassed $400,000.

This account was established just days before and invested over $30,000 just a day prior to the assault, reaping a profit of over $408,000. The activity raised eyebrows on social media, with many speculating that the individual behind the bet might have insider information—possibly even working for the Pentagon. Investor and podcaster Joe Pompliano quickly noted on X that “Insider trading is not only allowed on prediction markets; it’s encouraged.”

There have been previous instances of apparent insider trading on prediction markets, though the companies generally do little to address these issues. They often argue that they provide a platform not for a level playing field but for valuable news and insights. When we reached out to Kalshi, another prediction market, they pointed to a post on X stating that such insider trading violates their rules. We also contacted Polymarket for comment but have not yet received a response.

Update January 3rd: Added comment from Kalshi.